How to Evaluate a Rural EB-5 Project: Checklist for Investors

- Zoe Wollenschlaeger

- Aug 11, 2025

- 7 min read

As the EB-5 landscape evolves, rural investments are gaining momentum due to regulatory incentives and increased visa accessibility. Understanding how to evaluate a rural EB-5 project is essential for investors who seek both immigration benefits and financial protection. While rural projects can offer priority processing, visa set-asides, and a lower investment threshold, they also come with risks that must be weighed carefully.

This guide provides a comprehensive checklist for investors evaluating rural EB-5 opportunities, with a focus on regulatory compliance, project fundamentals, financial viability, immigration alignment, and professional validation.

The Rural Advantage: Why Rural EB-5 Projects Are in Demand

Rural EB-5 projects have become more attractive under the EB-5 Reform and Integrity Act of 2022 (RIA), which introduced special benefits such as:

Priority processing for Form I-526E petitions

20% visa set-asides exclusively for rural Targeted Employment Areas (TEAs)

Lower investment threshold ($800,000 versus $1,050,000 for non-TEA projects)

These features are particularly appealing to investors from high-demand countries facing EB-5 backlogs. However, their potential value doesn’t negate the need for proper evaluation—especially since rural markets typically lack the infrastructure and liquidity found in major metro areas.

How to Evaluate a Rural EB-5 Project: Step-by-Step Checklist

Follow these steps to make informed, confident decisions when reviewing rural EB-5 opportunities.

Project Developer & Regional Center Credentials

Before committing to any rural EB-5 opportunity, the first thing an investor should investigate is who is behind the project. The credibility of the developer and regional center can make or break the entire investment.

An experienced developer with a solid track record of delivering EB-5 projects in rural areas demonstrates an ability to navigate the complexities of construction, compliance, and job creation in often challenging environments. You should check:

Does the developer have prior experience in delivering successful EB-5 projects in rural areas?

Is the regional center USCIS-approved and in good standing?

Have previous investors received I-526 and I-829 approvals?

Is there a track record of returning capital to investors?

Why it matters: In rural areas, where economic and infrastructure challenges are often more pronounced, an experienced and transparent team increases your confidence in both project execution and immigration outcomes.

Job Creation Strategy and Economic Modeling

Since the core requirement for EB-5 immigration is the creation of 10 full-time U.S. jobs per investor, the job creation plan is one of the most critical elements of the project.

A strong project should support its employment projections with a third-party economic impact analysis that is:

Supported by a third-party economic impact analysis

Based on conservative assumptions about economic growth

Inclusive of both construction and operational jobs

Aligned with USCIS requirements for direct or indirect job counting

Why it matters: If the job creation target isn't met, your petition for permanent residency could be denied—even if the financial performance of the project is strong. Conservative, verifiable job creation models lower this risk.

Project Financials: Budget, Capital Stack, and Sources of Funds

Financial transparency is non-negotiable. You need to know whether the project has the resources to get built and succeed—without overreliance on EB-5 capital.

A well-balanced capital stack typically includes developer equity, bank financing, and EB-5 funds. Examine:

Full project budget, with detailed line items

Capital stack showing EB-5 vs. other funding sources (equity, debt, mezzanine)

Use of proceeds and timing of fund deployment

Developer’s financial commitment and skin in the game

Why it matters: Underfunded projects—or those too dependent on EB-5 funds—face higher risks of delay, job creation failure, and even collapse. A clear financial roadmap gives you confidence in project delivery.

Exit Strategy and Timeline Alignment

While the EB-5 visa is about immigration first, capital recovery matters, especially for high-net-worth investors managing large portfolios. A project’s exit strategy should be clearly defined and achievable within your expected immigration timeline.

Assess whether:

The exit strategy (refinance, sale, or cash flow buyout) is clearly defined

The expected exit date aligns with the investor’s I-829 petition

There are contingency plans in case the exit method fails

Market conditions realistically support the exit strategy

Make sure the project outlines how and when capital will be repaid, especially in a rural context where resale demand may be limited.

Why it matters: Without a viable exit plan, your capital could be tied up for years beyond your immigration process—or worse, lost. Clarity on exit timing and feasibility protects your financial goals.

USCIS Compliance and Immigration Milestone Support

A successful EB-5 investment isn’t just about the project—it’s also about ensuring the immigration paperwork is executed flawlessly. Strong projects will demonstrate:

Adherence to USCIS filing timelines and documentation standards

Support for investors throughout I-526E and I-829 processes

An understanding of redeployment and sustainment period rules

Experience handling Requests for Evidence (RFEs) and Notice of Intent to Deny (NOIDs)

Ask for examples of successful adjudications and how the regional center supports applicants through each immigration phase.

Why it matters: Even a successful project can derail your immigration if filings are delayed or mishandled. A compliance-oriented team ensures that both your green card and your investment are protected.

Location and Market Analysis

Just because a project is located in a rural TEA (Targeted Employment Area) doesn’t automatically make it viable. Investors must assess whether the region offers the economic fundamentals to support job creation and eventual project success. Look into:

Local employment rates, industry anchors, and economic diversity

Infrastructure, connectivity, and public amenities

Potential for growth, tourism, or commercial activity

Real estate trends and valuation metrics

A compelling rural project often lies in an emerging corridor or near a growing tertiary market—not in remote or declining areas.

Why it matters: Projects in economically depressed rural areas may qualify for EB-5 but struggle to meet job creation and exit goals. A strong local economy improves the likelihood of success on both fronts.

Legal and Broker Oversight

Work with licensed professionals who are familiar with rural EB-5 project risks and regulations. Ideally, a registered EB-5 broker dealer will:

Vet the offering for securities compliance

Ensure proper disclosures and risk warnings are included

Confirm the legitimacy of all offering documents

Help investors assess project feasibility based on their personal goals

In addition, your immigration attorney should:

Review the Private Placement Memorandum (PPM)

Clarify escrow and fund release conditions

Advise on compliance with sustainment and redeployment requirements

Why it matters: Fraud, mismanagement, and hidden risks are all too common in loosely vetted offerings. Professional oversight from an EB5 broker dealer and legal team adds a layer of protection and confidence.

Legal counsel should also review all agreements, PPMs (Private Placement Memoranda), and escrow terms.

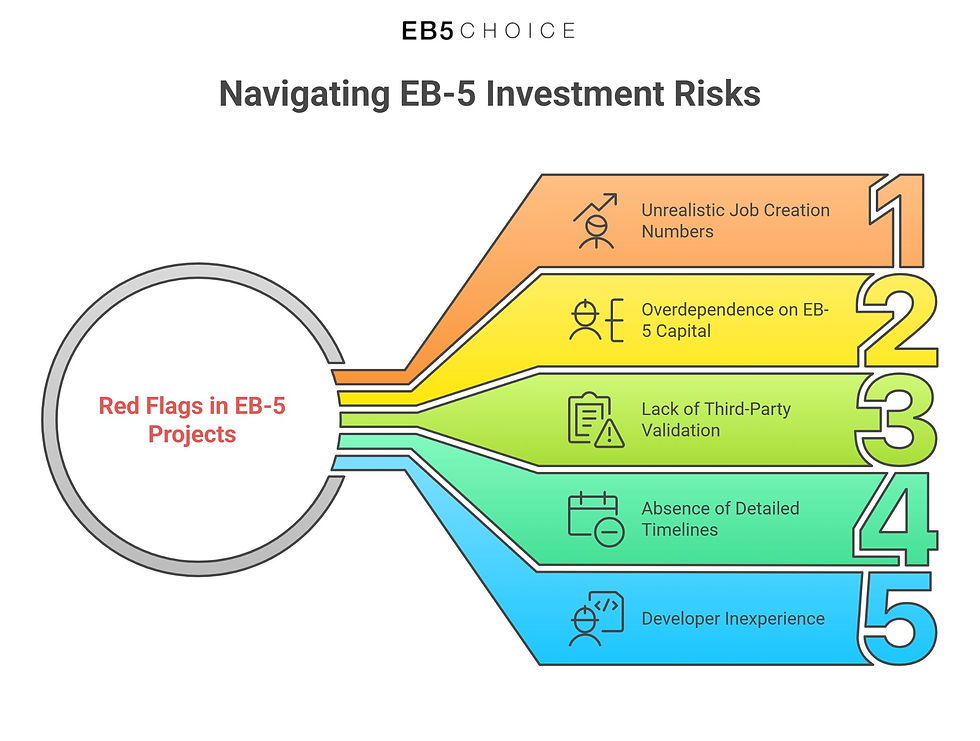

Red Flags to Watch For in EB-5 Projects

EB-5 investments can lead to U.S. permanent residency, but not all projects are equal. Spotting red flags early helps protect your capital and immigration goals.

Know what to watch for before you invest.

Unrealistic Job Creation Numbers Based on Aggressive Economic Multipliers

Some EB-5 projects present inflated job creation estimates using overly optimistic economic models or questionable assumptions. For example, a modest hotel in a small town projecting thousands of jobs based on high visitor projections or exaggerated operational revenues is cause for concern.

Credible job creation forecasts should be grounded in conservative data and supported by independent economic impact reports, not speculative modeling.

Why it matters: USCIS requires proof that a minimum of 10 full-time jobs per investor will be created. If actual job creation falls short of projections, it may lead to denial of the I-829 petition. Conservative, well-documented projections help protect your path to permanent residency.

Overdependence on EB-5 Capital with No Institutional Financing or Equity

A red flag arises when a project’s capital stack relies entirely on EB-5 investor funds, without substantial developer equity or participation from traditional lenders. This dependence indicates that banks or institutional investors may have found the project too risky or unviable.

A healthy project should include a diversified mix of capital—such as developer equity, senior loans, or mezzanine financing—alongside EB-5 contributions.

Why it matters: EB-5 capital alone is usually not enough to complete a project. Without institutional backing or developer investment, the project may face cash shortfalls or fail entirely, jeopardizing both your investment and your immigration goals.

Lack of Third-Party Validation Such as Economic Reports or Audits

Third-party validation—including audited financials, independent job creation reports, and feasibility studies—is essential for building investor trust. If a project lacks these external assessments, it’s difficult to verify whether key claims about financial viability, job creation, and construction timelines are accurate.

Projects that rely solely on internal documents or developer-prepared reports may be misrepresenting risks or omitting critical details.

Why it matters: Third-party validation provides objective insight and helps investors distinguish between marketing claims and realistic projections. Without it, you have little protection against misinformation, poor planning, or outright fraud.

Absence of Detailed Timelines for Construction, Job Creation, and Capital Return

A legitimate EB-5 project should offer a clear and realistic schedule that outlines key milestones, including construction phases, job creation benchmarks, and the capital repayment timeline.

When offering documents lack a well-defined timeline, or present vague estimates without contingency planning, it’s a signal that the developer may not have fully planned the project. This is especially risky in rural areas, where logistics and permitting can introduce delays.

Why it matters: Immigration milestones—such as I-526E and I-829 filings—depend on the timely creation of jobs. Additionally, the ability to exit the investment and receive your capital depends on when the project achieves liquidity. Ambiguous timelines increase both immigration and financial risks.

Developer Inexperience with Rural or EB-5 Ventures

Developers who are new to EB-5 or have no experience operating in rural areas may struggle to manage the complex legal, financial, and logistical requirements. Unlike urban projects, rural developments often face challenges related to workforce availability, local demand, supply chains, and regulatory hurdles. A developer unfamiliar with EB-5 compliance may also mishandle investor filings or fail to meet USCIS standards.

Why it matters: A developer’s lack of experience in EB-5 or rural execution increases the chance of missed immigration deadlines, failed job creation, or even project failure. Investors should prioritize sponsors with a successful track record of completed rural EB-5 projects, USCIS approvals, and capital returned to past investors.

Why Professional Guidance is Essential

Even the most diligent investor may miss subtle red flags or opportunities. A seasoned immigration attorney, a financial advisor with EB-5 experience, and a qualified broker-dealer can significantly improve your evaluation process.

Due diligence should not be a solo journey, especially in unfamiliar rural markets. Involving EB-5 professionals helps ensure your goals—whether focused on immigration or financial return—are protected.

Invest with confidence. EB-5 Choice will help you assess rural projects and protect your immigration goals.

Final Thoughts: Are Rural EB-5 Projects Right for You?

Understanding how to evaluate a rural EB-5 project means going beyond the benefits of visa set-asides and faster processing. It requires a thoughtful balance of regulatory insight, market data, and professional support.

Rural EB-5 projects can be ideal for investors seeking faster entry to the U.S. and lower investment thresholds. However, they demand extra attention when it comes to market feasibility, capital security, and immigration reliability.

Investors must approach each project as both a visa pathway and a financial commitment. With expert guidance, transparent information, and a robust due diligence checklist, your path to a US green card by investment can be both efficient and secure.

Comments