What Projects Qualify for EB-5 and Which Ones You Should Avoid

- Zoe Wollenschlaeger

- Aug 4, 2025

- 10 min read

The EB-5 Immigrant Investor Program offers a compelling pathway to obtaining a U.S. Green Card through capital investment in qualifying ventures. But not all projects meet the requirements. Understanding what projects qualify for EB-5 is crucial to ensure compliance with immigration laws, minimize risk, and safeguard your investment.

This blog explores the eligibility criteria, project types, common red flags, and guidance on avoiding substandard or fraudulent opportunities.

What Is the EB-5 Program?

The EB-5 Immigrant Investor Program was established by the U.S. Congress in 1990 as a pathway to stimulate the American economy by attracting foreign investment and fostering job creation.

Overseen by the United States Citizenship and Immigration Services (USCIS), the program offers a unique opportunity for eligible foreign nationals to obtain U.S. permanent residency by investment- commonly referred to as a “Green Card”- not only for themselves but also for their spouse and unmarried children under the age of 21.

To qualify, investors must:

1. Minimum Investment Amount:

Investors must contribute a minimum of $800,000 to a project located in a Targeted Employment Area (TEA)—typically rural regions or areas with high unemployment—or $1,050,000 if investing in a non-TEA location.

TEA investments are specifically incentivized to direct capital into underserved or economically distressed communities. The investment capital must come from lawful sources and may include cash or other tangible assets.

2. Job Creation

Each EB-5 investment must create at least 10 full-time, permanent jobs for U.S. workers. These can be direct jobs generated by the business itself or indirect jobs resulting from the project’s broader economic impact, especially in Regional Center investments.

3. Capital Must Be “At Risk”

The investor’s capital must be genuinely “at risk,” meaning it cannot come with guarantees of return or repayment. Additionally, the funds must be actively deployed in the business, not held passively in escrow.

This requirement ensures that the investment contributes directly to job creation and economic activity, aligning with the core goals of the EB-5 program.

What Projects Qualify for EB-5?

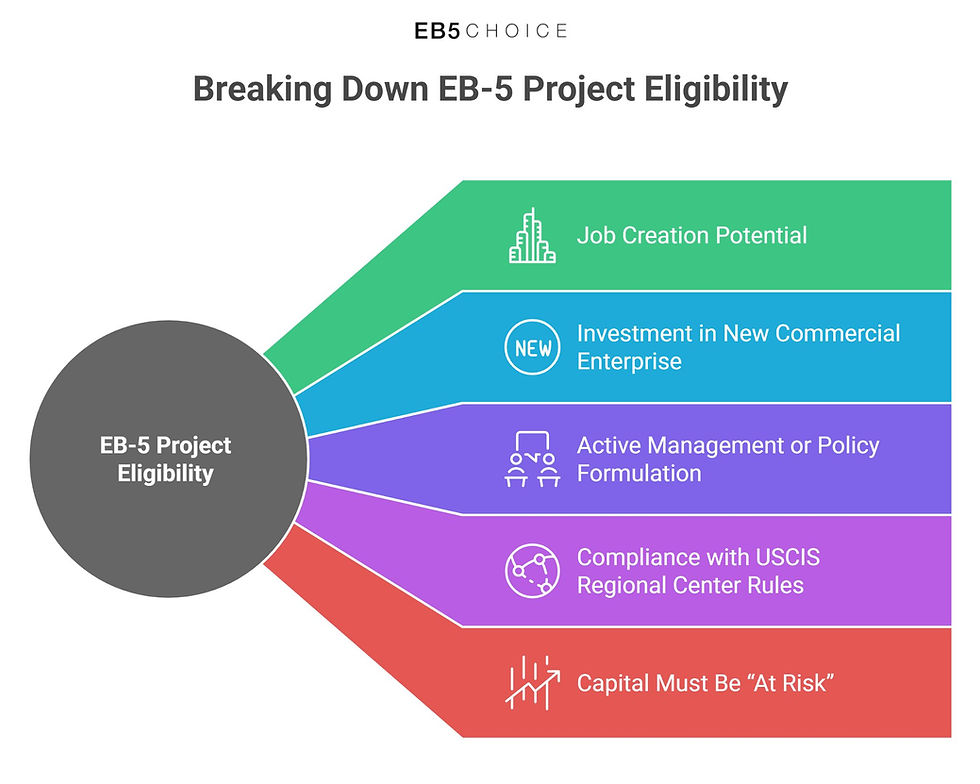

To be eligible for the EB-5 program, a project must meet a specific set of criteria defined by U.S. Citizenship and Immigration Services (USCIS). Understanding what projects qualify for EB-5 involves evaluating several core factors:

1. Job Creation Potential

One of the most fundamental requirements is that the project must create at least 10 full-time jobs for qualified U.S. workers per investor.

These jobs must last for at least two years and must be filled by U.S. citizens, permanent residents, or other legally authorized workers. Depending on the type of EB-5 investment—direct or regional center—these jobs can be:

Direct Jobs: Positions created within the business enterprise receiving the investment, typically seen in direct EB-5 investments.

Indirect Jobs: Jobs created as a result of the project’s economic impact on related industries, such as suppliers or service providers.

Projects that demonstrate robust, well-documented job creation projections—often verified by independent economists—are far more likely to qualify and succeed under EB-5 scrutiny.

2. Investment in a New Commercial Enterprise (NCE)

To qualify, the project must involve an investment in a new commercial enterprise (NCE). USCIS defines this as any for-profit activity formed for the ongoing conduct of lawful business, including sole proprietorships, partnerships, corporations, or holding companies. The NCE must either:

Be established after November 29, 1990, or

Involve the substantial restructuring, expansion, or reorganization of a business established before that date—mere asset acquisition or minor changes won’t qualify.

This requirement ensures that EB-5 capital goes into ventures that stimulate fresh economic activity rather than simply transferring ownership of existing businesses.

3. Active Management or Policy Formulation

Investors must play some role in the management or direction of the enterprise. In direct investments, this often means day-to-day operational involvement or holding a managerial position. In regional center investments, passive roles can fulfill this criterion, such as limited partners.

4. Compliance with USCIS Regional Center Rules

If the investment is made through a designated EB-5 Regional Center, the project must be affiliated with an approved center and follow its economic framework. Regional Centers are entities authorized by USCIS to pool EB-5 funds and direct them into projects that yield indirect job creation.

Projects under a regional center must submit comprehensive economic impact reports, job creation methodologies, and detailed business plans as part of the I-526E petition process..

5. Capital Must Be “At Risk”

In line with EB-5 program rules, the investor’s capital must be at risk for the purpose of generating a return, meaning there can be no promise of redemption, guaranteed return, or secured collateral. This rule is intended to ensure that the investment is genuine and contributes real risk-based capital to the U.S. economy.

Projects must demonstrate how the funds will be used and how the risk of gain or loss is possible, reinforcing the idea that the EB-5 program is not a mere passive residency transaction, but a legitimate economic investment.

Common Types of EB-5 Projects That Qualify

Many successful EB-5 projects fall into several key industry categories that align well with the program’s job creation mandate.

Real Estate Development

Real estate remains one of the most dominant categories in EB-5 investing. Projects such as hotels, commercial buildings, retail centers, and multifamily residential developments are popular because they often require large-scale construction and long-term management teams.

These projects are especially appealing to investors because job creation can be calculated using econometric models, including indirect and induced employment. Their predictability and the ability to scale make them a frequent choice for Regional Center-sponsored investments.

Hospitality and Tourism

The hospitality and tourism sector is another strong performer under the EB-5 program. Projects like luxury resorts, boutique hotels, theme parks, and entertainment complexes typically require significant staffing for operations—ranging from front desk personnel to food service workers and facility maintenance teams.

These businesses are labor-intensive and often located in high-traffic, tourism-heavy areas, ensuring a continuous demand for services and consistent job creation throughout the lifecycle of the investment.

Healthcare Facilities

Healthcare projects are increasingly seen as both socially impactful and economically sustainable for EB-5 investment. These include hospitals, urgent care clinics, outpatient surgical centers, and assisted living or senior care facilities.

Such projects generally involve both construction-phase jobs and long-term employment for medical professionals, caregivers, administrative staff, and support teams.

Given the rising demand for healthcare services across the U.S., these projects also provide a layer of recession-resilience and public need that appeals to EB-5 investors seeking stable outcomes.

Infrastructure Projects

Infrastructure development is a growing category within EB-5, particularly when structured as public-private partnerships. Projects such as transportation hubs, renewable energy facilities, water treatment plants, and broadband internet networks meet key criteria by creating construction and maintenance jobs.

These initiatives are often supported by local or state governments and contribute to long-term economic development in underserved areas. While infrastructure projects can be complex, they offer robust employment multipliers and align well with federal priorities for modernization and community impact.

Manufacturing and Technology

Manufacturing and technology-focused projects are attracting more EB-5 capital, especially in sectors like clean energy, electric vehicles, advanced materials, and biotech. These projects not only offer high job creation in engineering, assembly, and operations but also align with national innovation goals.

For example, a new electric vehicle battery plant or a medical device production facility could employ hundreds, with jobs ranging from skilled labor to research and logistics. These ventures often qualify for TEA designation and can present strong regional economic benefits, making them ideal candidates under the EB-5 framework.

Red Flags: What Projects to Avoid

While the EB-5 program offers a legitimate path to U.S. permanent residency by investment, not all EB-5 projects are created equal. In fact, some ventures may jeopardize both your financial capital and immigration goals if not properly vetted.

Understanding what to avoid is just as important as knowing what projects qualify for EB-5. Below are some major red flags every investor should recognize before committing funds:

Lack of Transparency

One of the first and most dangerous signs of a questionable EB-5 project is the absence of transparency. If developers are reluctant or unwilling to share vital information—such as detailed financial projections, project budgets, construction schedules, or job creation methodology—it raises serious concerns.

A legitimate and well-structured EB-5 project should provide clear documentation and allow investors full access to offering documents, business plans, and risk disclosures. Transparency is not optional—it’s a fundamental requirement for trust and compliance.

Overly Complex Financial or Ownership Structures

Projects with tangled webs of shell companies, offshore entities, and multiple tiers of debt or equity can be difficult to monitor and prone to mismanagement. These structures may obscure where investor funds are actually going or who controls the project.

Complex arrangements often introduce legal risks, conflict of interest, and even potential fraud. Simpler, cleaner structures with a clear use of EB-5 proceeds are generally safer and easier to assess. Always ensure that the business model and capital stack are clearly explained—and verified—by professionals.

No Third-Party Oversight

Strong EB-5 projects usually undergo due diligence by third-party economists, financial analysts, immigration attorneys, and auditors. These professionals assess job creation forecasts, financial feasibility, and compliance with USCIS guidelines.

If a project lacks any external validation or if the only endorsements come from internal or affiliated parties, that’s a major red flag. Independent review adds a critical layer of accountability and objectivity—helping protect investors from inflated claims or weak financial assumptions..

No Clear or Feasible Exit Strategy

A well-structured EB-5 project will include a clearly defined exit strategy for investors—typically occurring after the I-829 petition is filed and approved. This might involve refinancing, the sale of the project, or repayment from operational profits.

If a project fails to explain how and when investors will recover their capital, or if the exit depends solely on uncertain future events, you risk having your money tied up indefinitely. A lack of exit clarity not only endangers your return on investment but also contradicts sound financial planning.

Developer Inexperience or Bad Track Record

The developer’s background plays a pivotal role in project success. You should examine their history with past EB-5 or non-EB-5 projects: Did those projects meet their job creation goals? Were investors repaid? Were there any lawsuits, bankruptcies, or regulatory investigations?

A pattern of missed deadlines, underperformance, or legal entanglements is a serious warning sign. Choose developers with a strong track record, positive reviews from immigration consultants such as EB-5 Choice and other EB-5 industry professionals, and verified experience in managing both large-scale projects and EB-5-specific requirements.

Read our guide on Common EB-5 Investment Risks to spot red flags and safeguard your investment.

How to Evaluate an EB-5 Project

Choosing the right EB-5 project is one of the most critical decisions an investor can make. A solid project not only fulfills the job creation and investment requirements laid out by USCIS, but it also offers a realistic path to eventual capital return and U.S. permanent residency.

Below are five key evaluation steps to help you assess whether a project truly qualifies and meets your financial and immigration goals.

1. Review the Business Plan

The first step is a deep dive into the business plan, which must comply with the Matter of Ho standards as defined by USCIS. A compliant plan should include a detailed description of the business model, operational strategy, financial forecasts, and most importantly, a clear and credible job creation methodology.

This means outlining how the project will create at least 10 full-time jobs per investor and providing evidence that these jobs are achievable within a realistic timeframe. A strong business plan is the foundation of both financial and immigration success.

2. Third-Party Reports

Don’t just take the developer’s word for it—ask for independent, third-party documentation. Feasibility studies, market research, and economic impact reports from reputable firms can help validate the assumptions and projections made in the business plan.

These reports provide unbiased insights into the project's economic viability, demand in the marketplace, and potential for job creation. When such documents are missing or vague, it’s a red flag that the project may not have undergone adequate scrutiny.

At EB-5 Choice, we complete independent due diligence reports for EB-5 projects. Our Team can analyze the project in depth and determine its strengths and weaknesses so you can be confident in your project selection.

3. Scrutinize the Capital Stack

Understanding the project’s capital structure is crucial for gauging financial risk. The capital stack outlines how the project is funded—typically a mix of developer equity, bank loans, mezzanine debt, and EB-5 capital. Pay attention to where EB-5 funds are positioned: Are they senior, mezzanine, or subordinate?

Look for projects where developers have a significant equity stake, as this often indicates confidence and accountability. A clear, logical capital stack also tells you whether your funds are protected in the event of delays or financial setbacks.

4. Confirm TEA Designation

To invest at the reduced threshold of $800,000, the project must be located in a Targeted Employment Area (TEA)—either a rural area or one with high unemployment. Ensure that the TEA designation is not only valid but backed by up-to-date, government-certified data.

TEA status can directly impact your eligibility, timeline, and investment amount, so it's critical to confirm this early in the evaluation process. USCIS has increased scrutiny on TEA certifications in recent years, making this step all the more important.

5. Legal and Immigration Review

One of the most overlooked but vital steps is having the entire project reviewed by professionals. Work with a qualified EB-5 Broker Dealer, like EB-5 Choice, and EB-5 attorneys who understand both the immigration and securities aspects of the investment.

These experts can ensure that the offering documents are complete, the exit strategy is realistic, and the project complies with U.S. securities laws. Legal and immigration guidance also helps you avoid conflicts with USCIS rules and navigate the complexities of Form I-526E and I-829 filings.

Role of USCIS and Project Vetting

The United States Citizenship and Immigration Services (USCIS) plays a critical role in overseeing and regulating the EB-5 Immigrant Investor Program. However, it’s important to understand that while USCIS is responsible for evaluating the immigration compliance of an EB-5 project, it does not assess the financial soundness or profitability of an investment.

USCIS’s primary job is to ensure that a project meets the strict legal and programmatic requirements established for EB-5 investments. This vetting process occurs at the I-924 and I-956F application stages. However, approval does not guarantee financial success—it only confirms the project’s compliance with immigration rules.

The Importance of Due Diligence

Just because a project qualifies for EB-5 doesn’t mean it’s a safe investment. Thorough due diligence is critical to protect both your capital and your path to U.S. permanent residency.

USCIS approval ensures compliance with immigration rules—not financial viability. Investors must take extra care to assess each project independently.

Key Due Diligence Actions:

Background check on the developer: Investigate the developer’s history, track record in EB-5 or similar projects, and any past litigation. Poor performance or legal issues may signal future risk.

Examine offering documents: Review the Private Placement Memorandum (PPM), subscription agreement, and disclosures. These should clearly outline risk factors, fund use, and exit terms. Ambiguous language should raise concern.

Analyze job creation assumptions: Understand how the project plans to meet the job creation requirement. Confirm if third-party economists validated projections, especially for indirect or induced jobs.

Understand exit strategy options: Know how and when your capital will be returned. Projects should offer a realistic, defined exit plan that aligns with immigration timelines.

Confirm use of investor escrow accounts: Reliable projects use escrow to hold funds until conditions (like I-526E approval) are met. This adds a safety buffer and lowers financial exposure.

Conclusion: Making Smart EB-5 Choices

Understanding what projects qualify for EB-5 is essential for protecting your investment and immigration outcome. Choose projects with strong job creation plans, experienced developers, transparent financials, and viable exit strategies.

When in doubt, seek guidance from experts with a history of successful EB-5 filings.

With smart choices and expert support, the EB-5 program remains one of the most reliable routes to US permanent residency by investment.

Comments