Understanding Source of Funds Requirements in the EB-5 Program: A Comprehensive Guide for Investors

- Zoe Wollenschlaeger

- Feb 13, 2025

- 6 min read

Updated: Jun 18, 2025

The EB-5 Immigrant Investor Program provides a pathway for foreign investors to obtain U.S. permanent residency by making a qualifying investment in the U.S. economy. One of the most critical components of the EB-5 application is the source of funds requirement. To ensure compliance with U.S. immigration laws, the U.S. Citizenship and Immigration Services (USCIS) mandates that investors prove their investment capital was obtained through lawful means.

This article delves into the intricacies of the source of funds requirement, outlining what it entails, the documentation needed, and common challenges investors may face.

What Is the Source of Funds Requirement in EB-5?

The source of funds requirement is a fundamental aspect of the EB-5 program, which is designed to offer a route to US permanent residency by investment. It ensures that the money an investor uses to fund their EB-5 investment has been legally obtained and is free of any ties to illicit activities such as money laundering, fraud, or corruption.

USCIS requires comprehensive documentation to verify the legality of the funds, and failure to meet this requirement can lead to delays or even denial of the EB-5 petition.

Lawful Sources of Funds

The investment capital can originate from various lawful sources, including but not limited to:

Income from Employment: Salaries, bonuses, and other compensation from legal employment.

Business Profits: Earnings from a legitimate business enterprise, whether self-owned or operated by the investor.

Sale of Property: Proceeds from the sale of real estate, vehicles, or other assets.

Inheritance: Funds received from the estate of a deceased individual.

Gifts: Money received as a gift, provided that the donor can also prove the legality of the funds.

Loans: Funds borrowed, either secured or unsecured, as long as they are not derived from unlawful sources.

Documentation Required for Source of Funds

To satisfy USCIS’s source of funds requirement, investors must provide a robust set of documents that trace the funds from their original source to the EB-5 investment. This documentation must create a clear and unbroken financial trail, demonstrating that the funds were legally obtained and transferred.

Commonly Required Documents

Tax Returns: Certified copies of personal and business tax returns for several years, which help demonstrate the legal accumulation of wealth.

Bank Statements: Records showing deposits, withdrawals, and transfers, particularly those that detail the accumulation and movement of the investment capital.

Employment Records: Pay stubs, employment contracts, and letters from employers that corroborate income earned from lawful employment.

Business Ownership Documents: Articles of incorporation, business licenses, and financial statements that prove ownership and profitability of a business.

Property Sale Records: Sale agreements, deeds, and government tax records that document the sale of property.

Loan Agreements: Legal contracts that specify the terms of any loans, including details of collateral if applicable.

Gift Letters: A notarized letter from the donor affirming that the funds are a gift and do not need to be repaid, along with documentation of the donor’s source of funds.

Inheritance Documentation: Wills, probate documents, and legal records confirming the transfer of assets from a deceased individual.

Tracing the Funds

In addition to these documents, investors must be able to clearly trace the flow of funds from the original source to the final EB-5 investment. This means providing evidence of every transfer and conversion, especially when funds are moved between accounts or converted into different currencies. Any gaps or inconsistencies in this financial trail can lead to delays or requests for additional evidence (RFE) from USCIS.

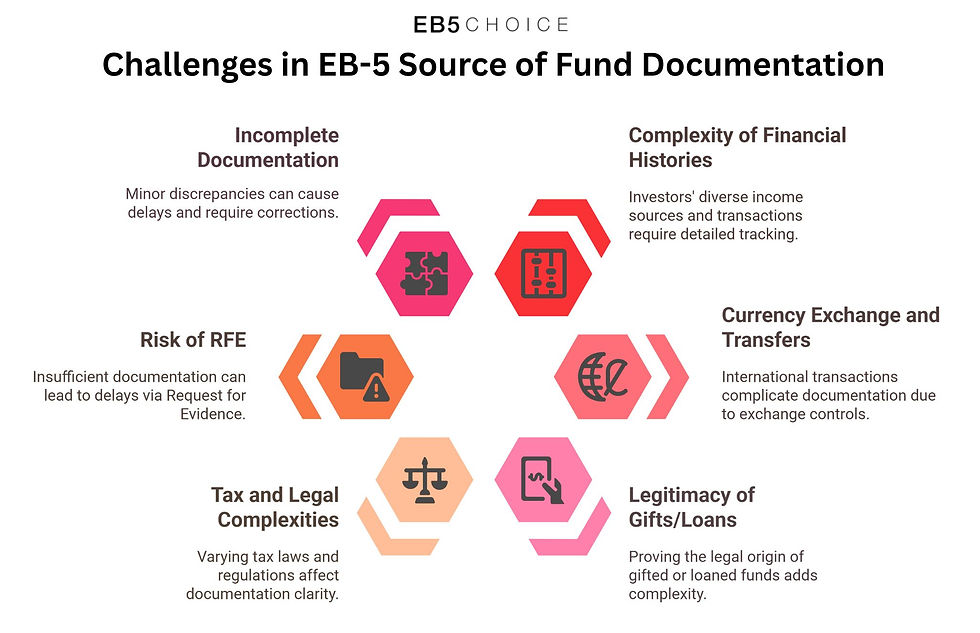

Common Challenges in Documenting Source of Funds

Complexity of Financial Histories

Many investors have complex financial histories, involving multiple sources of income, international transactions, and various types of investments. Creating a comprehensive and understandable paper trail can be challenging, especially when the funds have moved through multiple accounts or have been generated from diverse sources over a long period.

Solution: Working with an experienced EB-5 investment advisor is crucial. These professionals can help you organize your financial records, identify gaps in documentation, and ensure that your source of funds presentation is clear and convincing.

Currency Exchange and International Transfers

For international investors, funds often need to be converted from local currency to U.S. dollars and transferred across borders. These transactions can complicate the source of funds documentation, especially if there are exchange controls or restrictions in the investor’s home country.

Solution: Keep meticulous records of all currency exchanges and international transfers, including official exchange rates, transfer receipts, and any relevant government approvals. Your attorney can help you navigate these complexities and ensure that the transactions are documented in a way that satisfies USCIS requirements.

Proving the Legitimacy of Gifts or Loans

Some investors use funds that were gifted or loaned to them for their EB-5 investment. USCIS requires proof that these funds were legally obtained by the person or entity that provided the gift or loan, which can add an additional layer of complexity to the documentation process.

Solution: If you are using gifted or loaned funds, you will need to provide documentation from the donor or lender, including their financial records, a gift letter or loan agreement, and proof of the legal origin of the funds. It is essential to work closely with your attorney to gather and present this information accurately.

Navigating Tax and Legal Complexities

Different countries have different tax laws, reporting requirements, and financial regulations, which can affect the availability and clarity of documentation. Investors may also face legal challenges if their home country has strict regulations regarding the export of funds.

Solution: Engage a tax professional who is familiar with both your home country’s tax laws and U.S. tax requirements. They can help ensure that your financial documentation is compliant with both sets of regulations and that any tax obligations are appropriately addressed.

Risk of Request for Evidence (RFE)

If USCIS finds the source of funds documentation insufficient or unclear, they may issue a Request for Evidence (RFE), which can delay the processing of your application. RFEs often request additional documentation or clarification on specific points.

Solution: To minimize the risk of an RFE, it is crucial to be thorough and proactive in your documentation from the outset. Working with a knowledgeable EB-5 attorney can help you anticipate potential issues and address them before submitting your application.

Incomplete or Inconsistent Documentation

Even minor discrepancies or missing documents can lead to an RFE, delaying the processing of your EB-5 petition.

Solution: Double-check all documentation before submission and work closely with your attorney to identify and resolve any inconsistencies or gaps. Proactively addressing potential issues can prevent delays.

Best Practices for a Successful Source of Funds Submission

Given the complexity and importance of the source of funds requirement, it’s essential to approach this aspect of the EB-5 process with care and precision. Here are some best practices to help ensure a successful submission:

Start Early

Gathering and organizing the necessary documentation can take time, especially if you need to obtain records from multiple sources or different countries. Starting early gives you ample time to address any issues that may arise.

Be Thorough

Provide as much detail as possible in your documentation. It’s better to include more information than to risk leaving out something important. Make sure your financial trail is clear and logical, with no unexplained gaps.

Consult with Professionals

An experienced EB-5 attorney, financial advisor or an EB-5 broker dealer are invaluable resources throughout the source of funds documentation process. They can help you understand the requirements, identify potential challenges, and ensure that your submission meets USCIS standards.

Stay Informed

Immigration laws and regulations can change, affecting the documentation requirements for the EB-5 program. Stay informed about any updates that might impact your application and adjust your strategy accordingly.

Conclusion

The source of funds requirement is a critical and often challenging component of the EB-5 Immigrant Investor Program. By understanding what is required, gathering comprehensive documentation, and working with experienced professionals, you can navigate this aspect of the EB-5 process successfully. Ensuring that your investment capital is thoroughly documented and clearly traced to lawful sources is key to obtaining approval for your EB-5 petition and achieving your goal of U.S. permanent residency.

If you’re preparing to apply for the EB-5 program and need assistance with the source of funds requirement, our team of experts is here to help. Contact us today to learn more about how we can guide you through every step of the process.

Comments